Next: About this document ...

Up: lab_template

Previous: lab_template

Subsections

The simple model for growth is

exponential growth, where

it is assumed that

is proportional to

is proportional to  . That is,

. That is,

Separating the variables and integrating, we have

so that

In the case of exponential growth, we can drop the absolute value

signs around  , because

, because  will always be a positive quantity.

Solving for

will always be a positive quantity.

Solving for  , we obtain

, we obtain

which we may write in the form  , where

, where  is an

arbitrary positive constant. The same formula is used for exponential decay, except the decay constant

is an

arbitrary positive constant. The same formula is used for exponential decay, except the decay constant  is negative.

is negative.

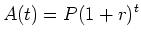

Suppose you invest a principal amount  at an interest rate

at an interest rate  and want to compute the future value

and want to compute the future value  after

after  years. Assuming that the interest is compounded once a year, the future value of the investment would be given by the formula

years. Assuming that the interest is compounded once a year, the future value of the investment would be given by the formula

. When the interest is compounded more frequently, say

. When the interest is compounded more frequently, say  times per year, then formula for the future value of the investment would be

times per year, then formula for the future value of the investment would be

If the case of continuous compound interest or

, then the future value of the investment would be

, then the future value of the investment would be

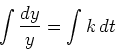

Now suppose you start with your initial investment  and add to that by making a regular investment of

and add to that by making a regular investment of  dollars per compound period. Then the future value

dollars per compound period. Then the future value  after

after  years with interest rate

years with interest rate  compounded

compounded  times per year is given by the formula:

times per year is given by the formula:

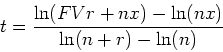

Suppose you want to figure out how long it would take to reach a desired future value, let's call it  . Then solving the above equation for

. Then solving the above equation for  would give how many years

would give how many years  it would take to reach this amount making regular investments of

it would take to reach this amount making regular investments of  dollars per compound period with interest rate

dollars per compound period with interest rate  compounded

compounded  times per year.

times per year.

The main functions you need are the natural exponential and

natural logarithm. The Maple commands for these functions are

exp and ln. Here are a few examples.

> A:=t->P*(1+r/n)^(n*t);

> subs({P=50,r=0.06,n=12},A(10));

> A:=t->P*exp(r*t);

> subs({P=50,r=0.06},A(10));

> A:=t->x*((1+r/n)^t-1)/(r/n);

> subs({x=50,r=0.06,n=1},A(10));

> t_yrs:=(ln(FV*r+n*x)-ln(n*x))/(ln(n+r)-ln(n));

> subs({FV=1000,r=0.06,x=50,n=1},t_yrs);

Consider the functions  defined by

defined by

To be able to get an inverse the function must be one-to-one. You can plot the

functions to get a hint as to whether they are invertible or not.

> f:=x->exp(x)+exp(-x);

> plot(f(x),x=-5..5);

> g:=x->exp(x)-exp(-x);

> plot(g(x),x=-5..5);

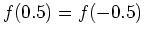

Both satisfy the vertical-line test but  is not invertible since it does

not satisfy the horizontal-line test. Indeed

is not invertible since it does

not satisfy the horizontal-line test. Indeed  is not one-to-one, for instance

is not one-to-one, for instance

. From the plot it seems that the function

. From the plot it seems that the function  is one-to-one.

In order to determine its inverse we solve for x.

is one-to-one.

In order to determine its inverse we solve for x.

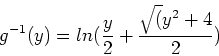

> solve(g(x)=y,x);

We observe that one of the solutions is not defined since the arguement of the logarithm can only be positive. Thus:

> ginv:=y->ln(y/2+sqrt(y^2+4)/2);

Let's look at the plot along with the line  to see if our functions seem to make sense.

to see if our functions seem to make sense.

> plot({x,g(x),ginv(x)},x=-20..20,y=-20..20,scaling=constrained);

Let's check that we have computed the right inverse. By definition the composot

ion of the functions should be the line  since an inverse is the reflectio

n about this line.

since an inverse is the reflectio

n about this line.

> g(ginv(y));

> simplify(%);

> ginv(g(x));

> simplify(%);

We are having difficulty getting  for the last composition. Think about what

issue the computer has in dealing with this simplification as you will come across this in the exercises.

for the last composition. Think about what

issue the computer has in dealing with this simplification as you will come across this in the exercises.

- Caclulate the future value of an ivestment of $1,500. earning 4.75% interest over a 9 year period using the formula for compound interest that compounds the interest for each of the following: yearly, semi-anually, quarterly, monthly, daily, hourly, and continuously. Explain what you observe.

- Use Maple's solve command to verify the formula in the background that calculates the time

in years that it would take to reach a desired future value

in years that it would take to reach a desired future value  making regular payments of

making regular payments of  dollars per compound period, compounded

dollars per compound period, compounded  times per year with interest rate

times per year with interest rate  .

.

- Use this formula to approximate the number of years it would take to save $50,000 if you invested $1200 per year with an average rate of return at 3.5% compounded yearly.

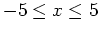

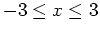

-

- A)

- Plot the function

over the interval

over the interval

and plot the function

and plot the function  over the interval

over the interval

. Which function is not invertible and why?

. Which function is not invertible and why?

- B)

- Find the inverse of the invertible function.

- C)

- Plot the function and its inverse along with the line

on the domain of

on the domain of

.

.

- D)

- Show that you have the correct inverse by using the composite definition. (When

you come across a simplifying problem and have figured out why the computer won't simplify ask your lab instructor how to bypass this problem.)

Next: About this document ...

Up: lab_template

Previous: lab_template

Dina Solitro

2006-10-03

![\begin{displaymath}A(t) = \frac{x\left[(1+\frac{r}{n})^t-1\right]}{r/n}\end{displaymath}](img20.png)